Mortgage Rate Outlook

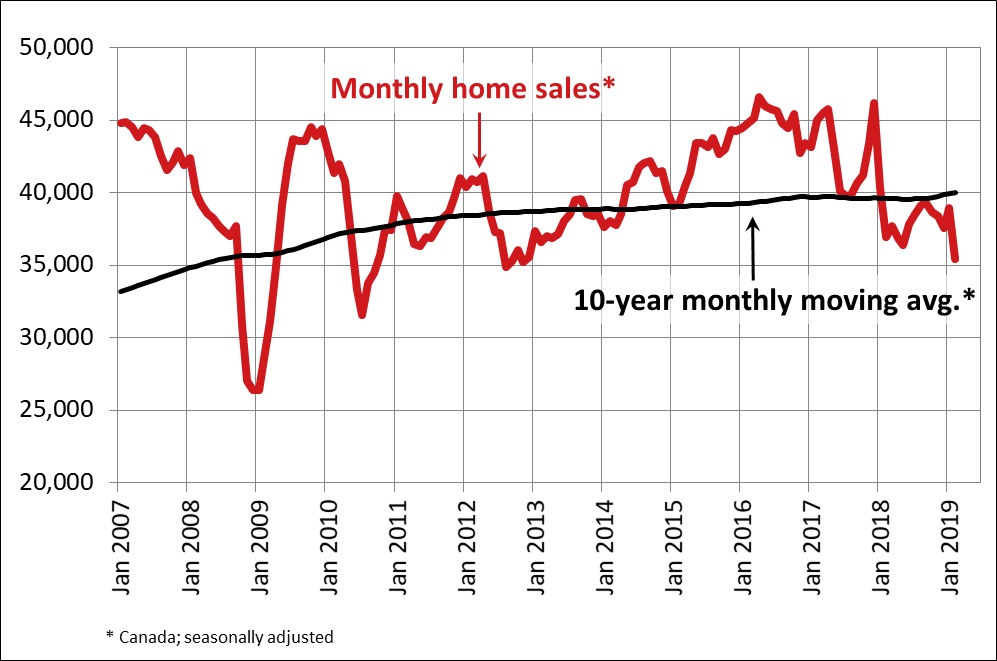

The once bright outlook for the Canadian economy darkened toward the end of 2018 amidst disruptions in Alberta oil production and a policy-induced slowdown in the Canadian housing market. This slowdown, along with global economic growth concerns, prompted a dramatic revision in market expectations for future Bank of Canada rate tightening. As a result, key benchmarks for bank borrowing costs plummeted, reversing course after a year of steady increases.

While those key benchmarks were falling, Canadian lenders delayed passing on savings to borrowers as the B20 mortgage stress test stifled growth in mortgage credit. However, as we move into the traditionally competitive spring housing market, mortgage rates are heading downward. The average contract rate for 5-year mortgages has declined about 30 basis points from its peak in 2018, reaching 3.44 per cent in March. Unfortunately, this still means a stress test rate of 5.44 per cent, even for the highest quality borrowers.

While contract rates are falling, the posted 5-year qualifying rate for insured mortgages has not budged in 11 months at 5.34 per cent. If 5-year bond yields sustain at their current level, a 5-year qualifying rate under 5 per cent should follow suit.

We are forecasting that lower mortgage rates will prevail for all of 2019 with the average 5-year contract rate falling to 3.30 per cent through the spring and early summer and the 5-year qualifying rate finally moving below 5 per cent for the remainder of the year. While there is an outside chance of a rate cut from the Bank of Canada, our baseline is for the Bank to remain on hold in 2019. Therefore, we are forecasting no change in the prime rate, from which variable rates are discounted.

Economic Outlook

The Canadian economy sputtered to the finish line in 2018, growing just 0.4 per cent in the final quarter of the year and contracting in the final month. This weak hand-off to the first quarter, drag from lower Alberta oil production and the ongoing negative impact of the mortgage stress test, compounded by rising interest rates last year, mean that slow growth will continue into the first half of this year.

We expect the Canadian economy will expand just 1.5 per cent in 2019 as it struggles to rotate from consumption and residential investment led growth to export and business investment led growth. The latter will be a particularly difficult shift as the Alberta energy sector continues to face significant challenges.

Of note, the Canadian yield curve has inverted, with the 10-year rate falling below the yield on a 3-month Treasury bill. This means that the average bond market investor expects an economic slowdown, substantial enough for the Bank of Canada to decrease its policy rate. While not always a reliable indicator of recession, an inverted yield curve does often portetend slower growth ahead.

Interest Rate Outlook

As 2018 drew to a close, it was widely expected that the Bank of Canada would continue on its rate tightening path this year, with the ultimate goal of returning the overnight rate to its “neutral” level of between 2.5 and 3.5 per cent. While slowing economic conditions have caused those expectations to be dramatically revised, the Bank’s ultimate goal remains. Policymakers would very much like to see the Bank’s overnight rate return to its estimated neutral level, meaning an interest rate that stabilizes Canadian inflation at its 2 per cent target. Our own estimate of the neutral rate is toward the low end of the Bank’s range. Using a standard model, we estimate that the real neutral rate, adjusted for inflation, is close to 0.5 per cent. Adding a 2 per cent rate of inflation brings the estimated neutral Bank of Canada rate to 2.5 per cent, or 75 basis points from where it stands today.

From that neutral rate, we can build an estimate of the neutral, or long-run, 5-year mortgage rate and, more importantly, we can gauge what the B20 stress test rate will be when the Bank of Canada returns to neutral. From that exercise, we can determine that when the Bank returns to its preferred level of policy rates, Canadians with more than 20 per cent in home equity will be stress tested at a rate much higher than what we estimate as a long-run equilibrium mortgage rate. Given the disruption caused in Canadian housing markets by the stress test at the presently lower rates, the stress test is not likely to be sustainable in the long-run as currently constituted.

nd slower growth ahead.

Provided by: BCREA

“Copyright British Columbia Real Estate Association. Reprinted with permission.”