Second Quarter – June 2020

Two years on from being buffeted by demandstifling government policies, the BC housing market was set to record a relatively normal year in 2020. However, hopes for a return to normal were upended by a worldwide pandemic that has thrown a blanket of uncertainty over the entire global economy.

With much of the economy at a standstill, and households and the real estate sector adhering to social distancing, activity in the housing market has slowed dramatically. Sales in the early spring fell to unprecedented lows and we anticipate that sales will remain below normal through the summer months.

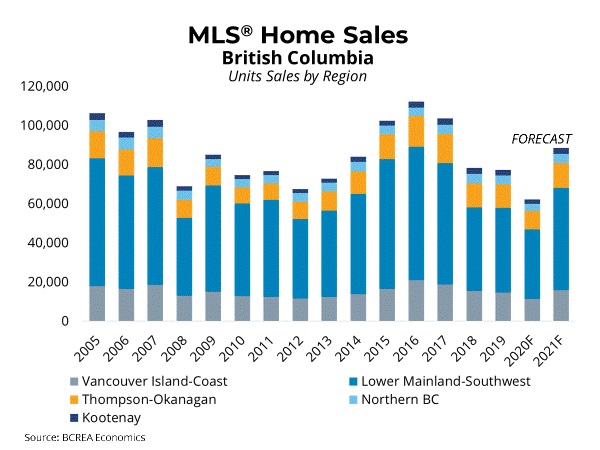

However, as the economy “re-opens” and measures to mitigate the spread of COVID-19 are gradually eased, we expect home sales will start to rebound, aided by record-low mortgage rates and pent-up demand. We are forecasting that provincial MLS® sales will fall 21.3 per cent this year to 60,885 units before posting a strong recovery to 88,490 units in 2021.

The impact of the current pandemic and associated recession on prices is largely determined by the reaction of supply. If the inventory of listings accumulates significantly, and particularly if that inventory represents foreclosures or motivated selling by those impacted by rising unemployment, prices will be more severely impacted. However, given the unusual nature of COVID-19, the supply of listings for sale has declined for at least the first month of the pandemic. Even when social distancing measures ease and normal recession dynamics take over, the total supply of homes for sale will likely peak at a lower level than would be expected given the underlying economic turmoil.

A muted rise in for-sale inventory along with plummeting interest rates and pent-up demand may translate to home prices remaining relatively firm in 2020. We are forecasting the provincial MLS® average price to finish the year up 1.8 per cent and increase a further 5.6 per cent in 2021.

Provided by: BCREA

“Copyright British Columbia Real Estate Association. Reprinted with permission.”

Comments:

Post Your Comment: